Incentives

Community FAQ

Cabarrus County uses economic development incentives or grants to encourage companies to locate or expand in our community. While there are many benefits to these programs, there are also many misconceptions about what they are and how they work.

Common Misconceptions

MYTH vs. FACT

- Companies are given cash up front as an incentive to come to Cabarrus County.

Incentives are performance-based reimbursements, which means they are not granted until after the company has met its requirements and has paid 100% of its tax bill.

- There is no oversight or accountability.

A tax assessor from the County audits the company, making sure they did everything they agreed to do. When the audit is complete, the company is given their tax bill and must pay 100% of it before they receive their incentive.

- Companies will come without an incentive.

While this is partially true for some companies, incentives are an important part of the cost-benefit analysis for projects that promise high-paying jobs and a large tax investment. These companies consider incentives an important part of their decision-making process. Without incentives, Cabarrus County wouldn’t have been able to land projects like Eli Lilly and Red Bull, nor would companies like S&D or Corning be able to expand here vs. their other locations.

- The County loses money on incentives.

In the last 25 years, Cabarrus County has received $6 for every $1 it has granted in incentives.

How do incentives work?

Cabarrus County incentives are performance-based.

Once a company has been approved for an incentive, they will construct their facility and hire people to fill the jobs that they agreed to create. A tax assessor from the County will then come out and make sure the company did what they were supposed to do. This includes making sure they installed all machinery and equipment they said they would install and making sure the investment is what they said it was going to be. The County determines the company’s property tax value and gives them their first tax bill, which must be paid in full. Then a portion of those property taxes are granted back to the company for a set period of time. At the conclusion of the grant term, the County retains 100% of the property tax.

Example: “Project Gem”

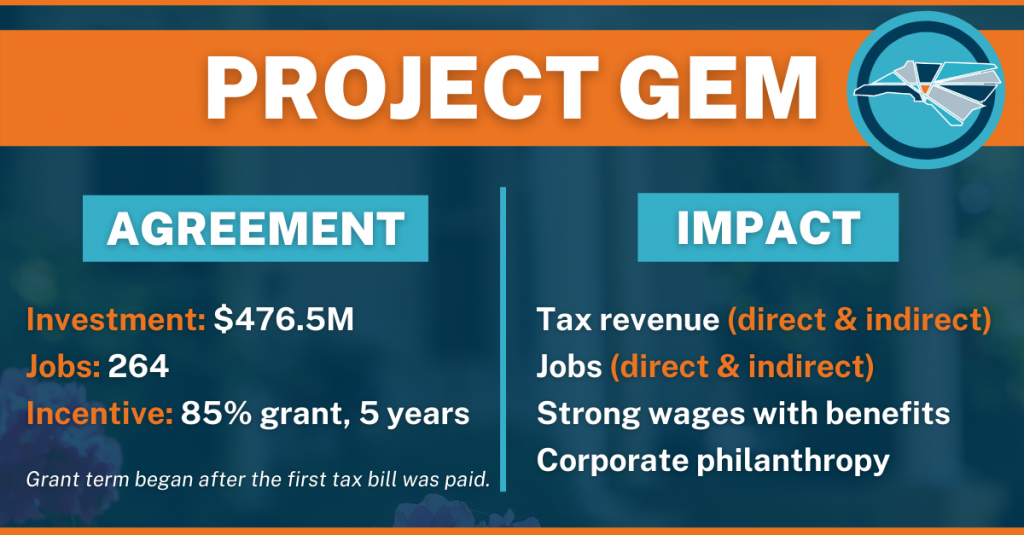

Let’s say “Project Gem” was approved for an incentive with a term of 5 years due to their large tax investment ($476.5M) and the 264 quality, high-paying manufacturing jobs they are creating in Cabarrus County.

- Project Gem’s first tax bill is $5.8 million, which is paid in full to Cabarrus County.

- After that, 85% of their property taxes were granted back to them for a period of 5 years ($4.9M for 5 years = $24.7M).

- Once the grant term has ended, the company returns to paying 100% of its taxes ($5.8M) on an annual basis.

- This tax revenue goes toward paying for services for Cabarrus County residents.

Why do incentives matter?

- According to Site Selection Magazine, the biggest “deal killer” for a company is a community not having the right incentives. As site selectors narrow down their list of potential locations, incentives become the tie-breaker between the final communities. If Cabarrus County does not offer incentives, we are at a substantial competitive disadvantage and we lose good jobs to other communities.

- Over the last 25 years, Cabarrus County has awarded $38.5 million in incentives, but has netted $252.2 million in tax revenue from those companies. That means that County received $6 for every $1 it awarded in incentives.

- Cannon Mills and Philip Morris showed us why it is so important to diversify our tax base and the jobs here in Cabarrus County. When a community has one or two primary employers, the lost of that industry can be devastating. Diversifying our tax base protects our economy from another shock like the closing of Cannon Mills while diversifying the jobs in our County allows more residents to stay here for work instead of commuting out of town.

What companies can receive incentives?

Not every company that requests an incentive will receive one. Local officials consider the industry, the investment, the number of jobs, the wages associated with those jobs and the overall community impact.

How are details such as grant length determined?

Every project is unique in its own way. Cabarrus County offers flexibility with a standard 3-year grant term, but in certain situations, the grant term will be increased, depending on the quality of the project and its competitiveness.

What happens when a company doesn’t perform?

Incentives are performance-based in Cabarrus County, which means that they do not kick in until after the project meets its goals for investment and job creation. If the company does not meet the promised outcomes, they do not receive any of the incentive. On the rare occasion that a company is in default of the grant terms after they have received an incentive, clawback provisions allow the County to recover any of the funds that have been dispersed.

How do State incentives differ from local incentives?

For the last decade, the State of North Carolina has been reducing taxes and increasing revenues. The State is attracting job creators that are expanding the tax base, making it less expensive for North Carolinians to live here. This has been possible thanks to the incentives that are offered by the State in conjunction with competitive incentives offered on a County level.

The most common State incentive is the Job Development Investment Grant (JDIG), which is calculated based on income tax. The company receives a rebate from the State based on the percentage of the personal income tax withholdings associated with the new jobs. Grant funds are disbursed annually, for up to 12 years, to approved companies following the satisfaction of performance criteria set out in the grant agreement. After the grant term runs out, 100% of the tax revenue is retained by the State.

Related FAQs

As the Cabarrus EDC attracts companies with large tax investments and high-quality jobs to our community, our local partners are working to develop training programs to prepare our current and future workforce for these jobs.

How does the community college prepare citizens to work for companies like Red Bull and Eli Lilly?

Most manufacturers have roughly an 85%/15% split between operators and technicians who are on the floor making product, and the engineers, scientific, marketing and administrative staff. Companies will typically have a broad, localized search for the 85% of employees that fall into the operators and technicians category.

Rowan-Cabarrus Community College spends time with companies to identify the skills their employees need, then they design programs to help them put people through training, either before they are hired or on the job.

An example is Eli Lilly plans to implement short-term, high-intensity certification-based training at the Advanced Technology Center in partnership with RCCC that will allow residents to learn the skills needed to qualify for the jobs that are coming to Cabarrus County. Funding from the Community College System allows residents to go through the certification program at little to no cost.

What role does the K-12 school system play in preparing our future workforce?

Both of our public school systems offer career academies at each of their high schools. These academies help us develop a skilled workforce and ready pipeline for any employer who chooses to locate and grow their business here.